Semiconductor market to rise again in 2024?

|

Getting your Trinity Audio player ready...

|

- WSTS anticipates a strong rebound in the semiconductor market, forecasting a growth of 13.1% in 2024.

- The memory sector is a crucial driver of this growth, with projections indicating a surge.

- Regional markets worldwide are poised for significant double-digit YoY growth in 2024.

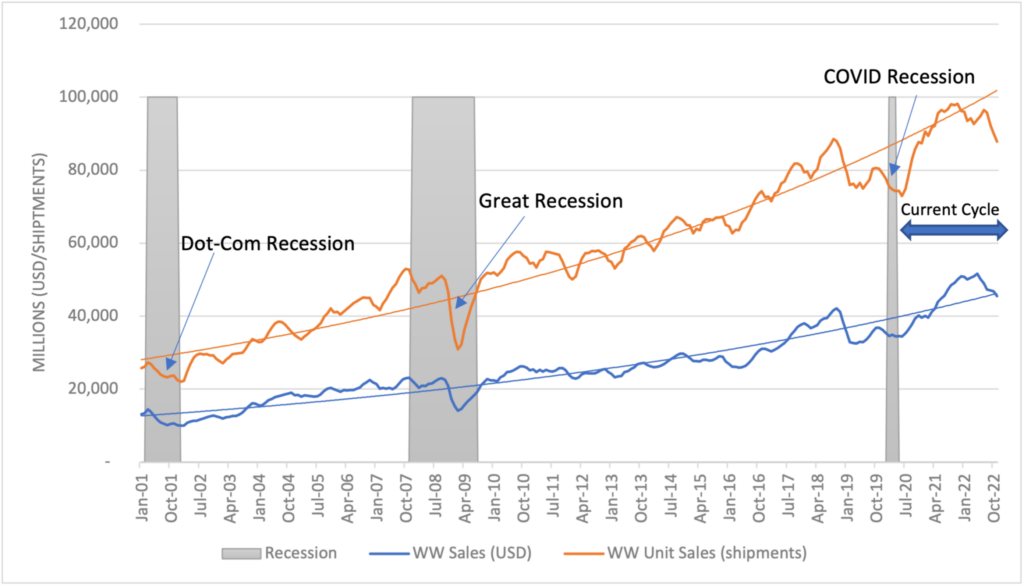

In the quarters since the pandemic, the semiconductor market has faced fluctuations influenced by factors such as supply chain disruptions, geopolitical tensions, and shifting consumer demands. Despite these challenges, the industry has showcased resilience and adaptability. The long-term trend over the last two decades reveals consistent growth, with annual sales soaring from US$139 billion in 2001 to US$573.5 billion in 2022—a 313% increase.

The semiconductor market’s current state and the projections for global sales show that this crucial sector is on the brink of transformative changes. Exceeding spring projections, the market experienced slightly better results in the second and third quarters this year, prompting a revised forecast by World Semiconductor Trade Statistics (WSTS). The outlook anticipates a single-digit contraction of 9.4% in 2023, reflecting the industry’s response to ongoing challenges.

Progress of the semiconductor market. Source: WSTS and SIA analysis

This year’s updated market valuation is estimated at US$520 billion, and the upward trend persists. “The outlook for 2024 points to a vigorous upswing in the worldwide semiconductor market, with projections indicating a 13.1% increase, reaching a valuation of US$588 billion,” WSTS’ report reads.

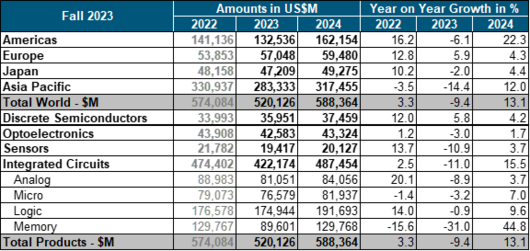

The industry growth is expected to be primarily fuelled by the memory sector, which is on track to soar to around US$130 billion in 2024, representing an upward trend of over 40% from the previous year. “The majority of other principal segments, including discrete, sensors, analog, logic, and micro, are also expected to record single-digit growth rates,” WSTS said in its report.

From a regional standpoint, all markets are poised for ongoing expansion in 2024. “The Americas and Asia Pacific, in particular, are forecasted to demonstrate significant double-digit growth on a year-over-year (YoY) basis,” WSTS highlighted. Similarly, even SEMI, in partnership with TechInsights, reported in the Semiconductor Manufacturing Monitor that the global semiconductor industry appears to be nearing the end of a downcycle and is expected to begin its recovery in 2024.

The Americas and Asia Pacific are anticipated to showcase substantial double-digit growth year-over-year. Source: IDC

“Market indicators point to a semiconductor industry bottoming at the end of the first half of 2023, and the industry has since started a recovery, setting the stage for continued growth in 2024. All segments are projected to log year-over-year increases in 2024, with electronics sales surpassing its 2022 peak,” SEMI’s report indicated.

The most upbeat outlook is from International Data Corporation (IDC), forecasting a turnaround and accelerated growth in the coming year. But for 2023, IDC believes worldwide semiconductor revenue will grow to US$526.5 billion, down 12% from US$598 billion in 2022. For 2024, IDC sees YoY growth of 20.2% to US$633 billion, up from US$626 billion in the previous forecast.

IDC’s optimism stems from the belief that the US market will show demand resilience, and China is expected to begin its recovery by the second half of 2024 (2H24).

Which semiconductor market will see sales growth?

For this year, revising its growth projections upward due to more robust performance in recent quarters, WSTS notes improvements in specific end-markets. “In 2023, discrete semiconductors, primarily driven by power semiconductors, are expected to see a 5.8% YoY growth. However, all integrated circuit categories, including analog, micro, logic, and memory, are projected to experience an 8.9% decline compared to the previous year, a less severe downturn than initially forecasted in May 2023,” WSTS noted.

Regarding regional performance for 2023, the research firm predicts only the European market is anticipated to grow, with a 5.9% increase. Conversely, the remaining regions are expected to face a downturn, with the Americas declining by 6.1%, the Asia Pacific region by 14.4%, and Japan by 2%. For 2024, IDC anticipates improved visibility in semiconductor growth as the extended inventory correction concludes in major market segments like PCs and smartphones.

What will the semiconductor market look like in 2024?

IDC also projected elevated inventory levels in the automotive and industrial sectors will normalize in 2H24, driven by the ongoing electrification trend that enhances semiconductor content over the next decade. “Technology and large flagship product introductions will drive more semiconductor content and value across market segments in 2024 through 2026, including the introduction of AI PCs and AI smartphones next year and a much-needed improvement in memory ASPs and DRAM bit volume,” the research firm noted.

As enterprises navigate the waves of change in the semiconductor market, the industry’s resilience and capacity for innovation remain critical drivers of its success. While short-term challenges persist, the long-term trajectory points towards a revitalized and dynamic semiconductor landscape, steering towards unprecedented growth and opportunities in the years to come.