- Only 13% of Americans feel financially better off this year than last.

- Employers can use tech to alleviate their staff’s money worries.

- TechHQ looks at three money-stretching tech-based benefits that employers can offer.

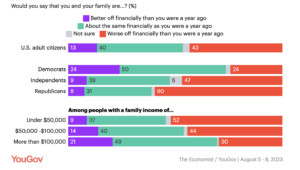

Despite the global economy’s slow recovery from the supply chain crisis and COVID-19 pandemic, it is still yet to be felt by most people. A new poll from YouGov revealed that only 13 percent of Americans feel they are better off financially this year than the last. Money remains tight – but there could be tech available that employers can use to help ease the pain.

Lower energy prices have curbed inflation slightly, yet real wages are still much lower than in 2022, meaning peopple are still struggling with mortgage repayments, rent, childcare, and other living costs. Employees are therefore relying heavily on their payday, and will be more appreciative of workplace benefits that help stretch their salaries further.

A recent Bank of America study revealed that 95 percent of employers feel a sense of responsibility for their employees’ financial wellness. While this paint a picture of compassionate capitalism, it is also in a company’s best interest for bosses to do what they can to ease any financial burden, as it can lead to increased employee satisfaction, productivity, retention, and loyalty.

In a time when the job market is competitive, companies that offer employee benefits are more likely to attract and retain top talent.

A new poll from YouGov revealed that only 13 percent of Americans feel they are better off financially this year than the last. Source: YouGov/The Economist

Many employers and businesses may be facing their own challenges, meaning that raises might not be feasible. In such cases, it becomes even more critical for employers to explore cost-effective benefits, initiatives, and tech options that can make money go further, and make a positive impact on their employees’ financial well-being.

TechHQ takes a look at three salary-stretching options available for US-based workforces.

- Access to funds before payday – DailyPay

DailyPay allows workers to access up to 100 percent of their earned wages before their scheduled payday. For employees living paycheck to paycheck, this service allows them to cover unexpected expenses, avoid high-interest loans or credit card debt, and gain greater control over their financial lives.

Employees using DailyPay save an average of over $1,200 a year on late fees, overdraft fees, and payday loan interest and fees. The employer-defined wage percentage is deposited into a dedicated DailyPay balance account as the employee earns it, using data from the timekeeping system in place.

The employee can then transfer this to their bank account, debit card, or payment card of choice in exchange for a transaction fee. Any pay that is not transferred out of the balance account will be automatically deposited into the employee’s primary bank account on payday.

DailyPay allows workers to access up to 100 percent of their earned wages before their scheduled payday. Source: DailyPay

While DailyPay has been compared to traditional payday lending because of its early wage access feature, there are significant differences. Unlike payday lending, DailyPay does not charge exorbitant interest rates or fees. Employees are charged a flat $3.49 fee to transfer the money from their DailyPay Balance account immediately, and there is no fee if they are happy to wait one to three business days.

Labor Day – but many people are living paycheck to paycheck.

Payday lending also traditionally preys on vulnerable individuals with high-interest loans and can trap them in cycles of debt, but DailyPay is a voluntary benefit offered by employers. Users are cautioned, however, that these single fees can add up if used consecutively and can push them into reborrowing. A report from California’s Department of Financial Protection and Innovation found that fees for early wage access programs averaged an annual interest rate (APR) of more than 300 percent.

- Emergency Savings Accounts – SecureSave

Emergency Savings Accounts (ESAs) are another financial tool that can help employees prepare for unexpected expenses. With a provider like SecureSave, employees can allocate a portion of their earnings to their ESA, which is separate from their regular savings or checking accounts, directly from their paycheck.

These funds are easily accessible in the event of medical bills, car repairs, essential home maintenance, or other expenses without the need to rely on high-interest loans, credit cards, or withdrawals from a retirement account. Employers can also match contributions or provide other incentives to make it even easier for employees to build a financial safety net.

SecureSave says that, on average, users have $1,000 saved after one year, and 89% of all emergency funds stay in the account. It is reportedly the first financial wellness product that has shown it can cultivate consistent employee savings habits at a large scale.

Offering ESAs as a benefit can also prove an attractive benefit for potential employees, as it demonstrates an employer’s commitment to their financial well-being. This, in turn, can lead to a more focused and productive workforce.

Funds stored in an Emergency Savings Account (ESA) are easily accessible in the event of medical bills, car repairs, essential home maintenance or other expenses. Source: Shutterstock

- Convenient expense management – BILL

Company expenses can act as a drain on your employees’ salaries. When required to front these costs from their own pocket, they may experience financial strain as they wait for them to be repaid.

What’s more, a clunky expense management process, where physical receipts need to be collected and approved, can lead to delayed reimbursements and potential errors in processing. This might result in employees not receiving the full amount they are owed or experiencing significant delays in getting their money back.

The time and effort spent on collecting, organizing, and submitting physical receipts can also add up, effectively reducing the productive hours that employees could have spent on their actual job responsibilities. In some cases, employees might even decide to forgo submitting smaller expenses altogether due to the cumbersome process, effectively absorbing those costs themselves.

Implementing a digital solution can enhance the efficiency of expense management processes, reducing administrative overhead and ensuring timely reimbursements for their workforce. The transition can also eliminate the need for physical receipts, as many solutions only require a photo to be taken and submitted digitally.

Implementing a digital solution can enhance the efficiency of expense management processes, reducing administrative overhead and ensuring timely reimbursements for their workforce. Source: Shutterstock

One such example is BILL Spend & Expense, formerly Divvy. The all-in-one spend and expense management solution is a combination of tech adn money processes that allows users to easily capture and submit expenses digitally by taking photos of receipts and entering expense details right from their mobile devices or computers.

It also provides real-time expense tracking, automated approval workflows, and comprehensive spend analytics, ensuring that employees no longer have to navigate a labyrinth of paperwork or endure lengthy reimbursement waits. This means they receive the full amount they are owed promptly, alleviating financial strain and improving their overall job satisfaction. Finance departments are also granted features for budgeting, vendor management, and spend optimization, allowing them to manage their company’s expenses effectively.