Split TikTok Shop from TikTok or risk losing your license, Indonesian government warn

- The new rule in Indonesia is a big blow to TikTok Shop, which relies on the country for e-commerce growth.

- All social media commerce platforms have a week to comply with the new rule or risk losing their license.

- TikTok Shop will be at least briefly stalled by the ruling.

In June this year, following intense scrutiny by US lawmakers, Shou Zi Chew, the CEO of TikTok, unveiled that his company would be investing “billions of dollars” into Indonesia and Southeast Asia. That investment will include US$12.2 million (S$16.4 million) to help more than 120,000 small and medium enterprises (SMEs) transition their businesses online and participate in the digital economy through TikTok Shop.

At that point in time, TikTok was already a rising star (and a threat to other e-commerce players) in the region. In Indonesia, TikTok Shop was phenomenal. “Across Southeast Asia, more than 325 million people come to TikTok every month, and 15 million businesses use the platform,” Shou explained at a forum during his visit. He highlighted that Indonesians alone comprised more than one-third (125 million) of the region’s total users, with more than two million selling on TikTok Shop.

Those numbers mean that Southeast Asia is TikTok’s biggest market in terms of users, and Indonesia, the region’s biggest economy and most populous nation, is the most significant market for the platform. So much so that Indonesia, a country of 278 million people, was the first to pilot the app’s e-commerce arm and could be a template for global expansion.

TikTok CEO Shou Zi Chew delivers his opening speech during the TikTok Southeast Asia Impact Forum 2023 in Jakarta on June 15, 2023. (Photo by BAY ISMOYO / AFP)

Unfortunately for the company and the businesses that use it, TikTok’s e-commerce thrust has been stalled abruptly in Indonesia by the local government in an attempt to defend offline merchants, marketplaces, and small enterprises.

In an unprecedented ruling that came into force last week, TikTok, and all other social media platforms, are compelled to split payments from shopping or risk having their licenses revoked.

The Indonesian government only allows social media to facilitate promotions, not transactions. “Social media [and e-commerce] must be separated so that the algorithms are not controlled. The provision will prevent the use of personal data for business purposes,” said Minister of Trade Zulkifli Hassan. Hassan also told a news conference that social commerce platforms would have a week to comply with the new rule.

So far, TikTok is the only social media company allowing for direct transactions and product promotions on its platforms. According to Hassan and a handful of other ministers within the government, including the country’s president, predatory pricing on social media platforms endangers the livelihoods of SMEs struggling to compete.

A local media report quoting the Director General of Public Information and Communications of the Ministry of Communications and Informatics, Usman Kansong, said Tiktok Indonesia has two permits from his ministry. “There are two permits: social media and e-commerce. But with Minister of Trade Regulation No. 31 of 2023, Tiktok must separate social media from e-commerce,” he added.

Usman told reporters that if Tiktok Indonesia separates itself from TikTok Shop and registers the latter as a separate entity, the e-commerce platform can return to business as usual. TikTok, predictably, is unhappy with the new ruling.

It argues that separating its social media from its e-commerce offering hampers innovation and hurts millions of merchants and consumers. The company says some rely on its platform to make a living, and that all its sellers are Indonesian or have local entities. For TikTok, the fresh restrictions in Indonesia open up a new front in the platform’s fight with regulators worldwide.

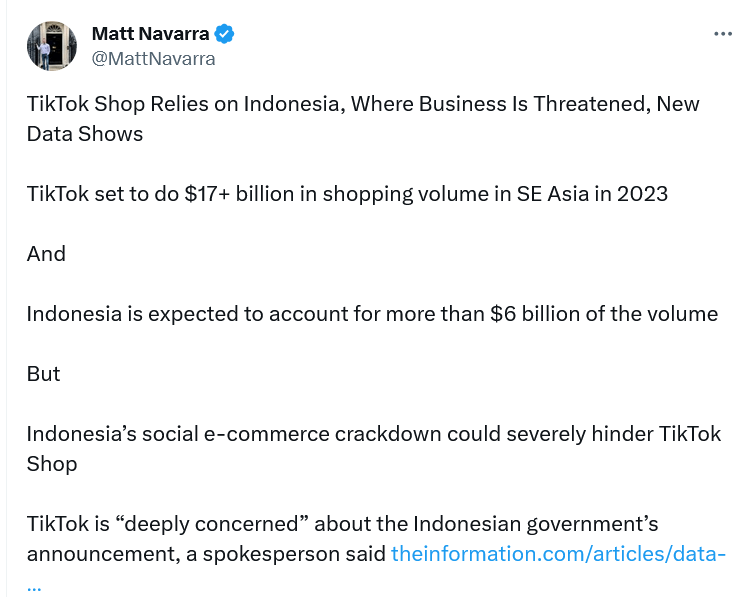

Concurrently, TikTok has been struggling with the US, Europe, and India over national security concerns. For TikTok in Indonesia, navigating the conflict will be pivotal for the platform as other governments watch its actions closely. For now, TikTok’s goal to grow its e-commerce business is facing its most significant stumbling block yet because of the significance of Indonesia as a market for the company.

What now for TikTok Shop in Indonesia?

By the end of 2022, TikTok Shop had become the fifth-largest e-commerce platform in Indonesia, according to data from Singapore-based venture Momentum Works. Last year, the country represented 42% of TikTok’s US$4.4 billion regional gross merchandise value (GMV).

Bloomberg Intelligence’s analyst, Nathan Naidu, believes TikTok’s possible split of e-commerce and social media operations in Indonesia could impede further conversion of its 125 million local monthly active users (MAU) into shoppers, benefiting Sea’s Shopee, which, like TikTok Shop, relies on beauty and personal care for most of its domestic sales.

“GoTo’s Tokopedia, which had 34 million MAU in August vs. Shopee’s 138 million and Alibaba-owned Lazada’s 37 million, should be better able to defend its GMV share in Indonesia, which drove 90% of the group’s 2022 sales,” Naidu added. Meanwhile, Jianggan Li, CEO of Momentum Works, noted in an email that Shopee has been voicing its support for Indonesian MSME exports yearly.

“Banning TikTok Shop could be operationally messy (and many of our friends say impractical). There are many different permutations of how things can evolve (eg, a separate e-commerce app or specific programs for MSMEs). Regardless of how the ban proceeds, TikTok’s vast consumer traffic will continue to be harvested for e-commerce, through TikTok Shop or other means, by TikTok or by other parties,” he noted.

Li also believes it is not too late for TikTok “to engage and turn the tide.” He believes TikTok needs to be bold and local.