Huawei ends DC lobbying: What’s next for US-China relations?

- Huawei has submitted a formal notice announcing the termination of its lobbying efforts at the Capitol.

- The move signals a more substantial attempt from China to decouple from the US.

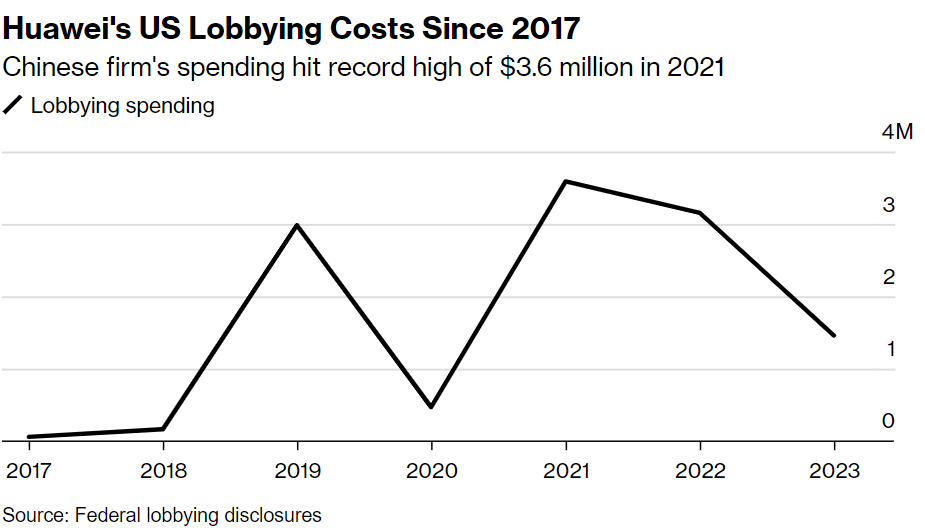

- The Chinese telecommunications giant allocated more than $13 million for lobbying efforts in the past decade.

More than a decade ago, Huawei Technologies, based in China, embarked on an extensive and costly mission to establish a stronghold in the North American market. In the early phases of this endeavor, the Chinese telecommunications giant significantly increased its lobbying expenditure in Washington, prompted by the US government’s investigation into potential Chinese espionage risks and threats to America’s telecommunications infrastructure posed by Huawei’s presence.

However, despite facing scrutiny since 2012, Huawei has vehemently and consistently denied all allegations, particularly those related to its supposed ties with the Chinese military. Washington has remained skeptical, considering Huawei’s global dominance as the world’s largest telecom equipment supplier and the second-largest mobile phone manufacturer. With its technology spanning the globe and a substantial budget dedicated to research and development, Huawei has emerged as a frontrunner in 5G technology.

The concerns escalated as Washington began questioning Huawei’s potential involvement in espionage, given its widespread deployment in numerous cell towers and network infrastructure throughout the US. Despite Huawei’s claims that its products posed no threat, by 2022, US regulators had taken stringent measures, prohibiting the company from selling its products in the US and imposing restrictions on its access to advanced technology.

Huawei continued its lobbying in the US as it still had ambitious plans for market expansion. The company had always planned to establish a stronger foothold in the American telecommunications landscape. But it became apparent that navigating the complex regulatory environment and addressing concerns related to national security were paramount.

Unsurprisingly, Huawei’s lobbying efforts faced formidable challenges, particularly as the company became a focal point in the US-China trade tensions. On top of espionage, allegations of cybersecurity threats and growing skepticism from policymakers posed significant hurdles.

In due course, Huawei became ensnared in a complex network of restrictions, notably being added to the Entity List by the US Department of Commerce. Despite challenges, Huawei adopted a multi-faceted approach to counter the negative narrative. The company invested heavily in building relationships with lawmakers, government agencies, and industry influencers. After all, Huawei has aimed to dispel concerns about its ties to the Chinese government and present itself as a responsible and transparent player in the global technology landscape.

Huawei also launched extensive public relations campaigns to improve its image. These campaigns highlighted the company’s contributions to technological innovation, job creation, and efforts to bridge the digital divide.

Eventually, the company initiated a gradual reduction in its lobbying endeavors, culminating in a complete cessation, as reported by Bloomberg last week.

How much did Huawei spend on lobbying in the US?

It was Huawei itself that officially notified the termination of its lobbying activities at the Capitol. The company has also discontinued its operations at the Plano, Texas offices, as confirmed by Trey Smith, the executive vice president at CBRE, a real estate services firm managing leases for the building, in an email to Bloomberg.

At its peak, Huawei boasted a squad of nine lobbying firms and a cadre of public relations representatives working in its service. Top-level executives frequently orchestrated briefings with congressional offices and prominent news outlets. Federal filings reveal that the company allocated over US$13 million to lobbying efforts in the last decade alone.

The Chinese wireless equipment maker spent tens of millions of dollars trying to win over US policymakers. Source: Bloomberg.

For context, in just one quarter of 2019, Huawei’s spending on federal lobbying skyrocketed to US$1.8 million, marking a six-fold surge from the previous year. The company’s total lobbying expenditure in the US for 2021 amounted to US$3.6 million, per official filings. Some of these funds were allocated to extravagant events attended by prominent figures, including seasoned Democratic lobbyist Tony Podesta, who reportedly earned US$1 million from Huawei that year.

Podesta officially concluded his work for Huawei on December 30, 2022, according to disclosures with the US Senate. “The US market isn’t a likely place for a breakthrough for Huawei in the near future,” Chris Pereira, a former Huawei public relations executive and founder of the consultancy iMpact, told Bloomberg.

With a solid ban in effect and minimal business presence in the US, Huawei has little incentive to continue depleting funds on lobbying efforts in Washington. So much so that the company’s final two registered lobbyists, Jeff Hogg and Donald Morrissey, departed in recent months.

Morrissey, who lobbied for Huawei and Futurewei, confirmed via LinkedIn that he departed the company in December. He now holds the position of senior director of government affairs at the battery technology company Gotion. Hogg, Huawei’s head of government relations since 2020, left the company in November, per his LinkedIn profile. Requests for comment from Hogg went unanswered.

“The lobbyists’ recent departures follow an exodus of staff from Huawei’s US operations and mark a quiet end to the company’s costly, years-long effort to maintain a presence in the North American market. The firm reached its peak by supplying small mobile firms across the US even as major carriers shunned it. Rising tensions with Beijing eventually all but banned it,” the report by Bloomberg reads.

With Huawei ending its lobbying gam, what’s next in the US-China tussle?

As Huawei bows out of Washington, it marks the end of a chapter in its American aspirations. Yet the company is far from bereft of alternatives. Responding to the US ban, China’s government has decried unfair practices, while Huawei pivots to cultivate its domestic market and spearhead technological advancements. For now, how Huawei fills the void left by the US market remains uncertain.

The upside is that Huawei is anticipated to shine brightly in the smartphone industry in 2024, and the China-based telco giant is poised for a substantial surge in global shipments, marking a projected double-digit growth. A report from research firm TechInsights recently suggested that the company might emerge as a significant surprise in the overseas market. Will Huawei dominate its native China after teh Mate Pro 60, and grow from there as a symbol of an alternative way for tech firms to expand?

Watch this space.