Memory chip market drags Samsung to its lowest profit in 14 years

• Samsung profits fell to a 14-year low in April-June.

• Chip slump forecasted to end this year.

• Recovery might be gradual, rather than meteoric.

Since mid-2022, the world’s largest memory chipmaker, Samsung Electronics Co., has been dealing with dwindling profits. The persisting economic headwinds and weak end-market electronics demand spreading from consumers to businesses have led to elevating inventories for semiconductor players, including the South Korean giant.

Samsung profits hit a new low – but is recovery on its way?

For as long as Samsung could, it has resisted pulling back memory chip investment to grab market share from rivals SK Hynix and Micron Technology, both of which have been forced to cut output due to a slump in demand. Unfortunately, prices for memory chips, its most significant business, continued to fall while demand stayed weak.

By early 2023, Samsung was forced to cut back memory chip production as it foresaw operating profit in the coming quarters would plummet. By the end of its January-March quarter, the company reported a whopping 4.58 trillion won (US$3.5 billion) loss in its chip business as memory chip prices fell further and its inventory values were slashed.

Even in a recent earnings guidance released on July 7, the South Korean technology giant predicted that its operating profit would continue to dwindle. In fact, Samsung believes its April-June quarter will see an operating profit of 640 billion Korean won (US$458 million), down from 14.1 trillion won (US$10.8 billion) a year earlier.

That 96% plunge reflects one of Samsung’s lowest profits in more than 14 years, mainly in line with forecasts, as an ongoing chip glut drives significant losses in the tech giant’s key business despite a supply cut. In a preliminary earnings statement, Samsung said that even second-quarter sales would likely fall 22% to 60 trillion won from 77.2 trillion won.

The end of memory chip downturn in sight

Analysts said the memory chip downturn that began last year is expected to hit bottom in the third quarter, although the rebound may start small. The global economic slowdown, inflation, and geopolitical tensions have prompted big pullbacks in corporate and consumer spending on electronics that drive demand for memory chips.

“Prices for the two main types of memory chips, DRAM and NAND flash, peaked during the Covid-19 pandemic, driven by strong demand for tech products. Prices began falling sharply in the second half of last year, and the slump has continued into 2023 amid a supply glut. DRAM memory enables devices to multitask, while NAND flash memory provides storage functions on devices,” a Wall Street Journal report explained.

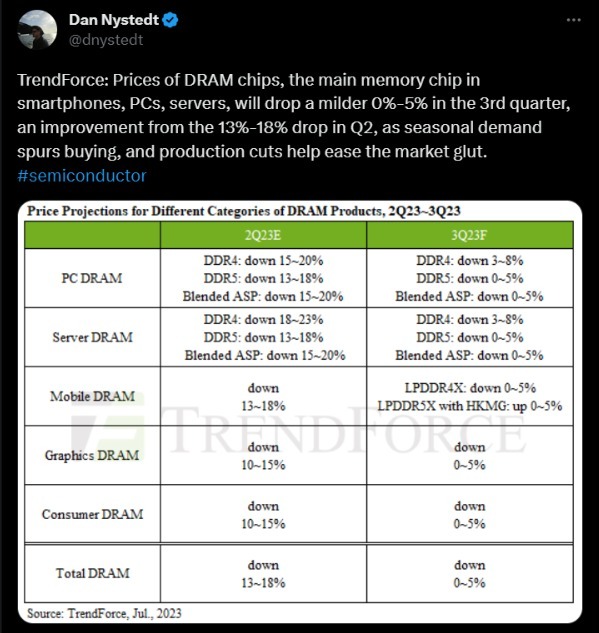

For context, prices of DRAM chips – widely used in smartphones, PCs, and servers – fell 13-18% in the second quarter as buyers refrained from new chip purchases, according to market tracker TrendForce. In the third quarter, average contract prices of DRAM are projected to fall by 7% and NAND flash by 1%, and in the fourth quarter by 3% and 7%, respectively.

While production cutbacks may help to curtail quarterly price declines, a tangible recovery in prices may not be seen until 2024.

Source: Trendforce

That compares with double-digit quarter-to-quarter price falls for both types of memory projected for the first and second quarters, according to TrendForce. Even Gartner’s latest forecast suggests that “recovery is on its way – the slump will bottom out this year.”

Gartner’s report also noted that memory is likely to be the hardest hit part of the sector, with revenue projected to decline 35.5% this year to US$92.3 billion, mainly due to overcapacity and excess inventory pushing down the price of memory chips. The upside is that Gartner expects to see memory bounce back with a vengeance next year with a forecast 70% growth in revenue.

“Whatever you say about the semiconductor market, it’s got bells on for memory,” Richard Gordon, Gartner VP for semiconductors and electronics, said in the report. Gordon says that global semiconductor revenue will decline by 11.2% in 2023.

“As economic headwinds persist, weak end-market electronics demand spreads from consumers to businesses, creating an uncertain investment environment. In addition, an oversupply of chips elevating inventories and reducing chip prices is accelerating the decline of the semiconductor market this year,” Gordon concluded.

Semiconductor Revenue Forecast, Worldwide, 2022-2024 (Billions of U.S. Dollars). Source: Gartner