Is Samsung losing its grip on the semiconductor market?

- Samsung is still being dragged down by its semiconductor division.

- The division reported a profit plunge of 78% in the third quarter.

- Samsung’s supply of chips for Nvidia’s GPUs could boost the company in the coming quarters.

When Samsung Electronics reported a 96% year-on-year drop in operating profit in the first quarter of this year, it was primarily attributed to its semiconductor division, which reported an operating loss of 4.58 trillion won. It was the division’s first reported loss in 14 years, starkly contrasting to when the business was the company’s main revenue stream.

But the 640.2 billion won ($502 million) loss for the first three months of the year was just the start of Samsung’s memory chip business downfall.

Following the company’s weakest quarterly performance in Q1 since 2009, Samsung continued its streak of losses. The South Korean giant reported another 4.36 trillion in losses in its semiconductor business in the second quarter. By July, Samsung Electronics’ semiconductor business was forecasted to post an annual loss of more than 10 trillion won for the year.

Will Samsung’s actions be enough to halt its semiconductor cataclysm?

According to securities firms on July 16, current estimates of Samsung Electronics’ annual operating losses in the Device Solutions Division run from 10.3 trillion won by Kiwoom Securities and KB Securities to 14.7 trillion won by NH Securities. Those estimates may be accurate, considering that during its recently-concluded third quarter, Samsung’s usually lucrative semiconductor division is anticipated to report a loss of over 3 trillion won.

Although the projected amount is lower than in previous quarters, it still signals persistent challenges within the chip market. For a start, memory chip prices have experienced a substantial decline throughout the year, primarily due to oversupply and reduced demand for devices like smartphones and laptops.

The downturn has significantly impacted Samsung’s profitability. In its previous earnings report from July, the company had forecasted an uptick in chip demand during the year’s second half. Still, this resurgence seems to be unfolding more slowly than was initially anticipated. To address this issue, the tech giant has reduced its chip production, although the impact of this measure is unlikely to be reflected in the third-quarter results.

Samsung issued preliminary Q3 results. Here’s what it shows

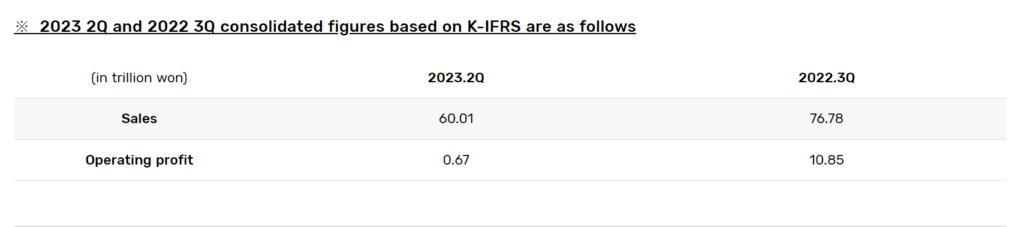

Samsung Electronics announced its earnings guidance for the third quarter of 2023 this week. Source: Samsung

Samsung issued earnings guidance on Wednesday this week. As anticipated by the company, there was a more modest slide in quarterly profit after staunching losses at its chip division all year. A Bloomberg report indicated that the 78% decline in operating income was better than most analysts had feared.

Experts think that memory chip prices have likely bottomed in the third quarter, with some types starting to rebound. According to Samsung’s preliminary results, the world’s largest memory chipmaker’s operating profit fell to 2.4 trillion won (US$1.79 billion) in July-September, on a 13% slide in sales. The numbers reflect an improvement from the record 95% year-on-year plunge in the previous quarter – but that’s not saying much, given the cataclysmic nature of that previous quarter’s results.

Analysts polled by LSEG expect an operating profit of 2.3 trillion Korean won (US$1.7 billion) for the September quarter, a 78.7% year-on-year (YoY) decline. Revenue is expected to come in at 67.8 trillion won, a fall of 11.6%, according to LSEG consensus forecasts. Samsung will give a more comprehensive snapshot of its earnings later this month.

A report by CNBC has indicated that there could be two possible bright spots for Samsung that could lead to better growth in the September quarter. First, its display division could experience an increase in sales compared to the previous quarter, thanks to the launch of Apple’s iPhone 15 series, for which Samsung supplies displays. Second, Samsung’s smartphone segment could witness enhanced profit margins, driven by the high-end foldable phones introduced in July.

In a less-than-ideal outcome, Daiwa Capital Markets said in a note earlier this month that it expects Samsung earnings to miss consensus estimates “due to the higher cost burden from the memory production cut and ongoing soft demand” for its chip manufacturing unit, known as the foundry business. Daiwa analyst SK Kim sees operating profit for the third quarter at 1.65 trillion won, much lower than the average analyst estimate of 2.3 trillion won.

However, Kim sees the inventory glut easing and memory prices rising in the fourth quarter. Separately, a Citi note in August suggested that Samsung will begin supplying advanced memory chips for US semiconductor giant Nvidia’s graphics processing units, which are used for AI. Kim suggests that will be a boost for Samsung, adding: “We expect growing opportunities related to AI demand in 2024.”

Terrible two: Samsung faces semiconductor and smartphone market slump

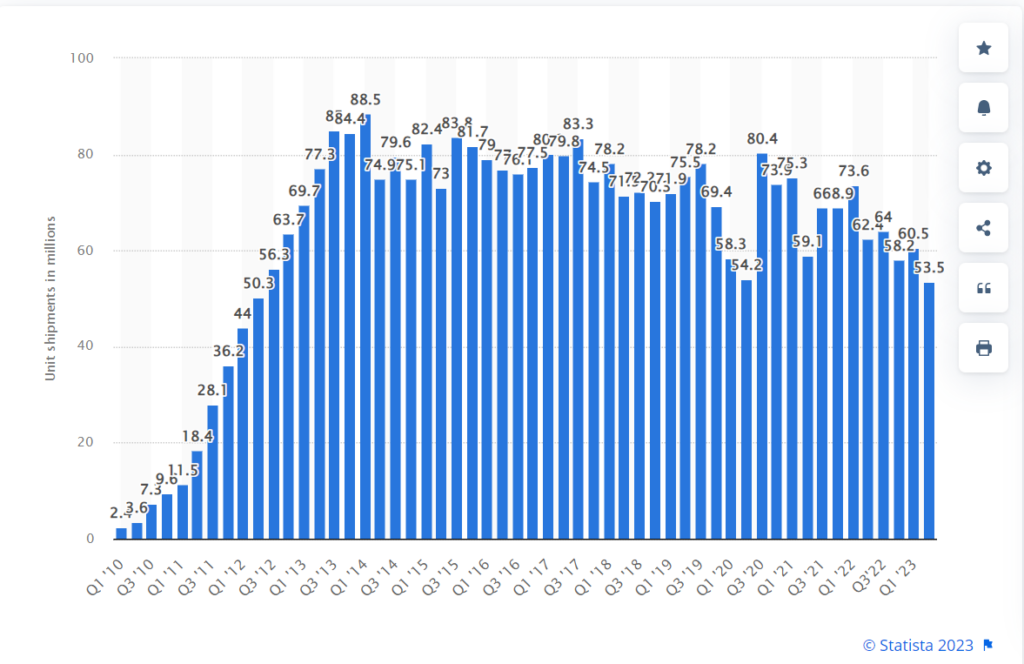

The global smartphone market has been in a slump for the past two years, and the first half of 2023 saw the most significant shipments drop in years. Most smartphone players, including Samsung and Apple, continued recording dips in their loads. But it has been worse for Samsung, which saw a more significant drop.

According to data from CasinosEnLigne.com, the South Korean tech giant shipped 114 million smartphones in the year’s first half, a 16% drop from the 136 million reported in the first half of last year. Overall, global shipments of smartphones are expected to decline by 3.2% in 2023, according to a forecast from International Data Corporation’s Worldwide Quarterly Mobile Phone Tracker.

Recovery is only anticipated from 2024 onwards.

Global smartphone unit shipments of Samsung 2010-2023, by quarter. Source: Statista