US DOE goes big on next-gen batteries

|

Getting your Trinity Audio player ready...

|

There’s big money in batteries. And that figure is now USD 125 million higher following the announcement by the US Department of Energy (DOE) that it will be investing further in next-gen battery chemistries, materials, and architectures. According to the DOE, the money will pay for research to find ways of overcoming the current limitations of lithium-ion technology. To fill the energy gap left when switching from fossil fuels to cleantech, battery makers need to come up with designs that go beyond the capabilities of lithium-ion technology.

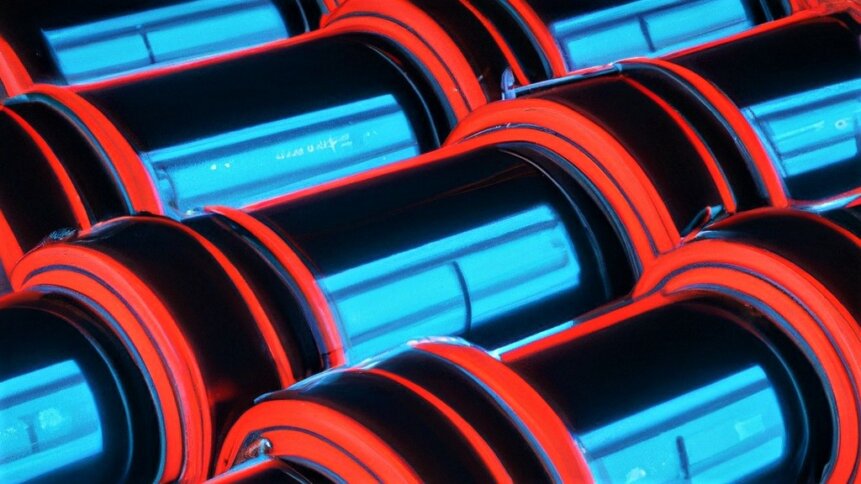

Lithium-ion battery cells are currently the hot ticket that’s helping to drive the boom in electric vehicles (EVs). Battery-powered cars from makers such as Tesla have thousands of individual lithium-ion cells that together enable the EVs to travel hundreds of miles on a single charge. But lithium-ion technology is far from perfect and suffers from a range of drawbacks.

What are the limitations of lithium-ion technology?

- Lithium-ion batteries are fragile and require careful handling. A protection circuit and other battery management features, which accompany the cells and supervise their safe operation, means that users don’t have to concern themselves. But all of the auxiliary equipment adds weight and cost.

- Overcharging lithium-ion batteries reduces their life and could cause a fire. Also, letting the electric charge stored in cells fall too low will also prematurely shorten their lifespan.

- Lithium-ion batteries are sensitive to temperature. EV coolants used in battery packs (to stabilize cell temperature during fast charging) are a growth area for developers such as BP. The energy giant supplies EV fluids to the Jaguar TCS Racing Formula E team, which relies on cutting-edge battery technology.

- Using lithium-ion batteries for large-scale energy storage requires a significant upfront investment as components are expensive, especially when competition for materials further inflates prices.

Since being commercialized by Sony in the 1990’s, lithium-ion batteries have gone from strength to strength. And the technology continues to evolve. But for some applications, agencies such as the DOE believe that superior energy storage designs can be found. Plus, the demand for lithium-ion cells – analyst firm McKinsey, is one of many expecting global demand for the technology to soar – will put pressure on finding alternatives if supply chain issues arise. McKinsey forecasts a demand of 4700 GWh by 2030 (up from 700 GWh in 2022) for lithium-ion batteries.

What could next-gen batteries look like?

There are a number of alternatives to lithium-ion batteries, and the list includes:

- Flow batteries

- Lithium-air batteries

- Lithium-sulfur batteries

- Metal-air batteries

- Solid-state batteries

- Sodium-ion batteries

- Super-capacitors

- Zinc-based batteries

Technology such as super-capacitors is already in use as an auxiliary to batteries – for example, providing a charge boost in cold weather and enabling rapid energy recovery in electric motors. And designs such as flow batteries and sodium-ion batteries could help in applications such as grid-scale storage for scenarios where space permits – both designs have a lower energy density compared with lithium-ion batteries.

Flow batteries, where energy stored in liquid electrolyte is pumped through a cell to generate electricity, are (in principle) highly scalable – this is an important attribute for large deployments offering grid-scale storage. Sodium-ion designs could also prove to be promising. The technology is less mature compared with lithium chemistries, but future designs would benefit from the greater abundance of sodium compared with lithium on the planet. Sodium is the sixth most abundant element on earth, whereas lithium ranks 31st.

Solid-state batteries have the potential to push energy storage densities beyond that of lithium-ion cells thanks to their compact size. And Nissan-Renault-Mitsubishi, Toyota, and Samsung are just a few big names investing in the technology. There’s a raft of start up activity in the area too. But manufacturing solid-state batteries is challenging due to the precision involved. Although, just as manufacturers of lithium-ion cells were able to perfect their production over time, it’s feasible that research and development –funded through DOE and other channels – could pay dividends in the longer term.

Battery market dynamics

Today, China dominates the battery landscape, with the FT reporting that manufacturers CATL and BYD hold 50% of the market. CATL’s annual output could power more than 3.3 million EVs. And figures from battery industry analyst firm SNE Research show that BYD has overtaken Korea’s LG Energy Solution as the global number two. Firms in the US and Europe too are racing to become more competitive in battery manufacturing. Tesla has a gigafactory in Nevada, US. And other ambitious battery makers include Northvolt, which is committed to powering its factories with clean energy. In July, the Sweden-based company raised USD 1.1 billion to support factory rollout plans in Europe.

It’s worth remembering that the latest DOD funding comes on top of an investment just shy of USD 3 billion (announced in Feb 2022), intended to boost the production of advanced batteries for electric vehicles, energy storage, and other cleantech applications. For energy independence, the US wants to ensure that it is capable of producing sufficient batteries as well as being able to source the necessary materials that go in them. Australia, which sits upon a treasure trove of minerals, is keen to deepen its involvement in battery production. Queensland alone has identified the potential to contribute USD 1.3 billion in economic activity in battery-related areas such as mining, refining and active mineral production, cell manufacturing, and pack assembly.

In the UK, the Faraday battery challenge shares GBP 27.1 million in funding across projects addressing next-gen batteries, including fast-charging infrastructure and building a circular battery economy to optimize materials use. And cycling back to the theme at the top of the story, there’s big money in batteries.