New energy source found almost everywhere on earth

• Sodium batteries could become a viable alternative to lithium in some use cases.

• Sodium is significantly cheaper and easier to get at than lithium.

• There’s room for both battery types, and using sodium could stabilize lithium prices.

READ NEXT

How to save a battery’s life

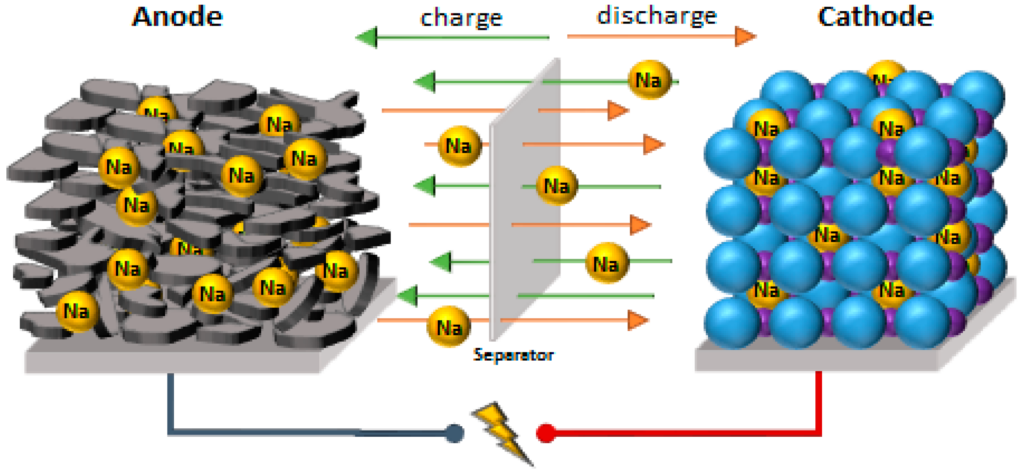

In the world of technology, rivalries between different methodologies go back at least as far as Edison and Tesla – and probably further still. For all we know, there may have been competing methodologies for getting great slabs of stone into place during the building of the pyramids, because it’s human nature to find contrary ways to do things. Now though, a new battle is beginning: sodium vs lithium batteries. Battery manufacturers are shifting away from lithium and instead putting their money into new sodium-based technology, signalling another shakeup in the industry. Sodium – salt – naturally occurs in rocks and the ocean, making it cheap and easy to come by.

That’s a huge advantage over lithium, which currently dominates the battery world. Sodium is chemically and structurally similar but has yet to be used on a large scale, partly because lithium cells can get a better range and performance in similarly sized cells.

It’s like being back in highschool science class…

Then, this week, Sweden’s Northvolt AB announced that it had made a breakthrough with the technology, and Chinese EV maker BYD signed a deal to build a $1.4 billion sodium-ion battery plant. It follows China’s CATL announcing in April that its sodium-based batteries will be used in some vehicles from this year.

“It’s serious investment,” said Rory McNulty, senior research analyst at Benchmark Mineral Intelligence. “It’s creating a confidence boost with them saying we are here to continue scaling capacity to commercialize this technology.”

Can sodium at least partially replace lithium batteries to help the planet?

The success of sodium-ion products would curb lithium consumption.

Lithium mining predominantly takes place in African countries that the Global North seems to have no issue, either historically or currently, with exploiting for its own benefit. A Global Witness investigation into three mines in Zimbabwe, Namibia and Democratic Republic of Congo (DRC) found that far from delivering ‘just energy transition,’ the industry is fuelling corruption and other environmental, social and governance problems.

Short trip, last mile, and cross-site travel – on grains of salt?

The low energy density of sodium-ion batteries makes them unsuitable for larger EVs, but that doesn’t mean they couldn’t be used instead of lower-end, shorter-range vehicles – or for power grid energy storage, where size isn’t such an issue.

Internet veterans might remember this?

In fact, as the world shifts away from fossil fuels, storing excess electricity for grids is increasingly important and that’s the clearest potential advantage of sodium-ion cells.

According to Bloomberg, sodium-ion batteries should cut around 272,000 tons of lithium demand by 2035, or more than a million tons, if lithium supplies can’t meet usage demands.

The changes in what metals are used in batteries has upended supply and demand outlooks and cut prices. Just a few years ago, cobalt and nickel were facing long-term shortages. Now, demand estimates have been revised because of the emergence of cells that don’t use them.

Lithium especially highlights the potential for huge price swings: a buying frenzy sent prices soaring through last year before plunging as EV demand disappointed and supply prospects improved.

“Sodium-ion will have a part to play in improving the lithium supply-demand balance,” said Sam Adham, head of battery materials at consultancy CRU Group. “It will dampen those really severe swings in lithium prices.”

Even though lithium prices have dropped, sodium remains the cheaper option. If the market grows, it might echo the rise of lithium-ion phosphate cells that have been preferred to higher-performing products because – you guessed it – they’re cheaper!

The success of sodium will somewhat depend on improving cell life – that is, how many times they can be charged and discharged before needing replacement. Sodium products currently average 5,000 cycles, compared to the most cost effective lithium products which achieve more like 7,500.

More demand for sodium products will only come once those numbers match more closely. For now, the developing sodium-based cell sector looks to be dominated by Chinese producers who already have control over most lithium-ion battery production. The scale of their operations keeps costs down, giving an advantage over European and American rivals.

Regardless of the level of sodium-ion battery uptake, it being a feasible alternative is bound to shake up the industry – an industry that’s crucial to the energy transition away from fossil fuels.