• Price increases feel inevitable as Asian manufacturers raise wages.

• The price rises will correspond to Gen Z demands in Asian factories.

• The prices of consumer goods have been minimized by very low wages.

Price increases on items manufactured in Asia are coming to a toy store near you!

Americans have grown used to a wide range of products being available at (relatively) cheap prices, including clothes, electronics, furniture, and toys. The rise in online sellers from China have only reinforced this snese of continual availability at inexpensive prices.

The issue with this model of relative cheapness is that for all of those things to be so affordable, they have to be manufactured at an even lower cost. For years, that’s meant that stores in America have lined their shelves with items made in factories in Asia.

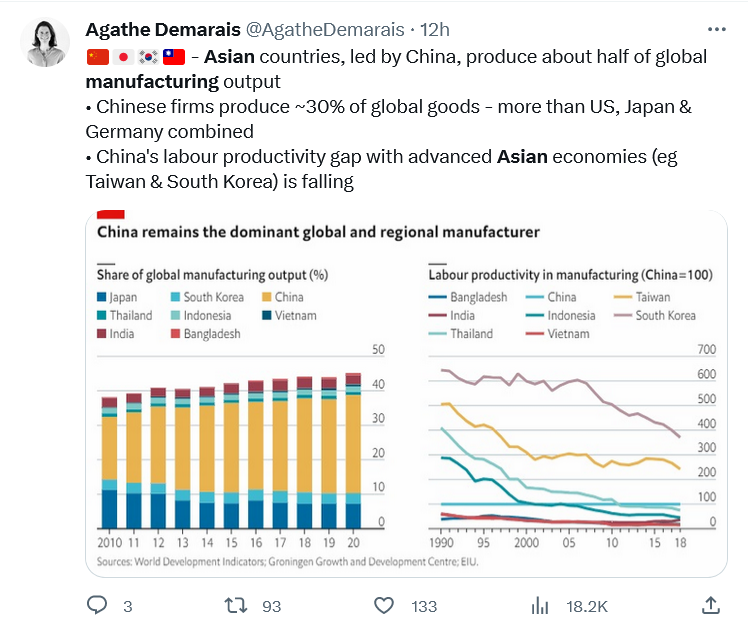

For the past couple of decades, cheaper overseas manufacturing costs in Asian countries like China have kept prices low in the US and Europe.

However, the younger generation in Asia don’t want to be factory workers. So, factories need to represent better prospects; manufacturers are raising wages and offering other perks.

The average age of factory workers in Asia has gone up. Source: EPA-EFE via South China Morning Post.

Yoga classes, better cafeteria food, and subsidized kindergarten for workers’ children are all good news for Asian factory workers. They will all also inevitably drive up the cost of manufacturing. To offset that, there have to be price increases in retail.

Price increases a result of staff shortages

The rising costs in factories haven’t come out of nowhere: in China, manufacturing workers’ wages have more than tripled in the last ten years. Japan, Vietnam and Malaysia have also seen notable bumps.

“For US consumers that have been used to having goods at a certain and relatively stable part of their disposable income, I think that foundation is going to have to be rejigged,” Manoj Pradhan, a London-based economist, told the Journal.

It’s hard to feel that much sympathy for Westerners who will be upset about price increases when those increases will represent fairer employment practices in Asia.

The labor shortage in Asia’s factories is attributed to several factors. Firstly, young workers are pushing back on working conditions, while others hold out for higher-paying jobs in line with their education levels.

“After a while, that work makes your mind numb. I couldn’t stand the repetition,” former Chinese factory worker Julian Zhu told VOA News last November.

Even though many factories are in need of workers, unemployment rates among China’s 16-24-year-olds hit 21% last quarter. In 2001, Nike’s typical Asian factory worker was 22. Today, the company’s average Chinese worker is 40, and in Vietnam the standard age has reached 31 years old.

As an effect, price increases have already begun. Companies like Nike, as well as toymakers Hasbro and Mattel have attributed price hikes to elevated labor costs in Asia.

The pandemic and Russia’s invasion of Ukraine caused supply chain trouble that made businesses consider how far their products had to travel before going on sale. The broader decoupling between the US and China, dating back to the trade wars of the Trump administration, hasn’t helped, either.

What can be done about price increases?

Some companies might move operations from Asia onto home soil. This would have the advantage of creating American jobs, and of improving supply chain resiliency – but it isn’t going to stop price increases.

And before we roll our eyes at Asia’s Gen Z workers, asking their employers for more money, better conditions, and better prospects than their mothers’ and their grandmothers’ generations, it’s worth considering how much an American manufacturer pays its staff.

Even given the absurdly low wages of most American factory workers, products are always more expensive when they’re Made in America due to relative living standards.

The Asian economies remain a production juggernaut…but…

Late in 2022, Apple, Walmart, Intel and Lockheed Martin were among corporations that were reported to be taking steps to “reshore” or “onshore” their supply chains. The moves caused warnings about the inflationary implications of a Made in America economy: in November 2022, a Goldman Sachs report said that among the efforts made by US companies to improve supply chains, “reshoring poses the risk of boosting prices.”

YOU MIGHT LIKE

Is Apple bringing more manufacturing into Thailand?

Ynon Kreiz, CEO of Mattel IRL. Source: CNN.

Another option is “nearshoring.” Companies including Mattel are shifting supply cahins to countries closer to the US: in 2019, the company closed two of its Asian factories and spent US$50 million on the expansion of an existing plant in Mexico.

Will Ferrell as Mattel CEO in the Barbie movie.

According to Mattel’s Latin America managing director, Gabriel Galvan, “being able to have product close to your consumer and not having to transport it from Asia, that’s going to be more profitable and more competitive when you take costs into account.”

Mexico offers cheaper labor than the US and lower shipping costs than Asia. Whether that’s enough to offset price increases remains to be seen.