No terminal? No problem! How to accept customer payments on your iPhone

If you were to walk up to a checkout today, ready to make a purchase, but were told the store only accepts cash, chances are you would walk out empty-handed. Recent surveys have found that just 18 percent of all US payments are made with cash, and over half of Americans now make contactless payments. Naturally, the move to digital payments was exacerbated by the pandemic, but even now, there is no sign of preferring a return to paper over plastic. For small businesses, in particular, who have to offer more to remain competitive with the larger players, it is imperative to provide as many digital payment options as possible: credit cards, contactless payments, PIN debit, and EBT.

Souce: Payanywhere

However, many of these options require the business to have a payment terminal to capture cardholder data and run the transactions. The initial investment for purchasing and setting up these point-of-sale systems can be a financial burden, especially for small businesses operating on tight budgets. As well as the hardware, costs include the associated software, installation fees, and necessary staff training.

Additionally, ongoing maintenance and regular upgrades are necessary to keep these systems functional and secure. Outdated hardware or software can pose security risks, leaving businesses vulnerable to data breaches and fraud. Indeed, any network outages, software glitches, or hardware malfunctions can also result in downtime, potentially leading to loss of sales and customer dissatisfaction. Keeping up with the latest technology and security standards often requires additional investment of time and money.

Wouldn’t it just be easier to accept payments on your iPhone? Well, now you can!

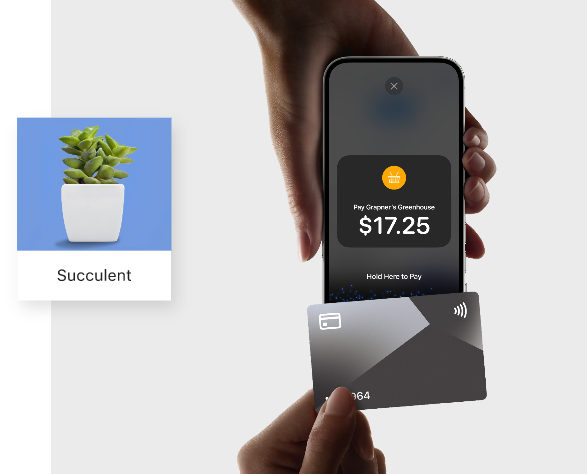

The Tap to Pay on iPhone feature in the Payanywhere app allows merchants to accept digital payments directly on their smartphones, eliminating the need for payment terminals. Customers simply tap their preferred payment device on the seller’s iPhone to complete the transaction. This could be their contactless debit or credit card, Apple Pay on an iPhone or Apple Watch, or other digital wallet.

To authorize a Tap to Pay on iPhone payment, the merchant launches the Payanywhere iOS app, enters the transaction amount, and selects “Tap to Pay on iPhone” from the list of payment methods. The iPhone can then be presented to the customer so they can place their card or Apple Pay-enabled device over the contactless symbol. When the “done” checkmark appears, the transaction is complete. During the process, the app will clearly display the amount the customer is being charged, the merchant’s name, category icons, and directions for completing the payment, creating a transparent and easy payment experience.

Tap to Pay on iPhone uses the device’s built-in near-field communication (NFC) system to securely connect the merchant’s smartphone with a consumer’s contactless payment card or mobile wallet. The technology complies with Payment Card Industry (PCI) security standards for mobile payments on commercial off-the-shelf devices. Payments use EMV infrastructure and take advantage of iPhones’ built-in security features, like encryption and tokenization, to keep payment data safe. After the payment is processed, card data is not stored on the merchant’s Apple device or Apple’s servers.

Tap to Pay on iPhone offers customers a convenient, fast, and secure payment method. The feature can also read loyalty cards or discounts stored in Apple Wallet when the customer is making a payment, so they can get a stamp or save without even remembering their membership. If the company offers a loyalty card supported by Apple Wallet, the app can be set up to notify customers that they can join its rewards program and enjoy discounts in the future. The Tap to Pay on iPhone feature also offers numerous benefits to merchants. iPhones are the world’s most popular smartphone, with Apple holding a 29.67 percent market share in mobile vendors. This means most merchants already have access to the necessary hardware and don’t need to invest further in a terminal or its associated maintenance and upgrades. The technology can be used to accept payments for rideshares, at roadside stands, from food trucks, at festivals, and at the checkout counter, with a device that sellers have with them anyway.

Source: Payanywhere

Enterprise and large businesses can leverage Tap to Pay on iPhone to complement the payment systems they have in place, for example, giving them an easy way to manage transactions at curbside pickup, in a drive-thru lane during peak times, or for line-busting during the holiday shopping season. It is also a convenient method of accepting payments for additional items that click-and-collect customers choose to purchase when they arrive at the store to pick up their orders.

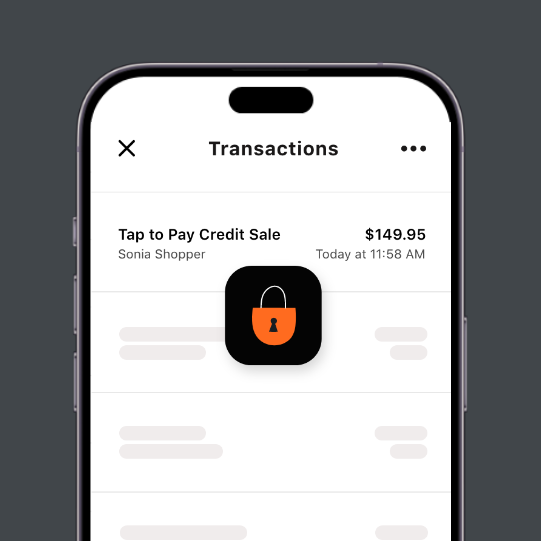

Other convenient features that Payanywhere’s solution offers include the ability to look up a customer’s past purchases so sellers can confidently issue a refund without a paper receipt. Merchants can also add a token to a customer’s file for recurring payments, like gym memberships or subscriptions. Research has found that subscription services have grown almost five times faster thanretail sales in the US.

Payanywhere, the sixth-largest non-bank merchant acquirer in the US, has a dedicated team of over 1,300 that provides world-class customer service and facilitates more than $100 billion in transactions annually. To find out how your business can benefit from offering easy, secure, and private contactless payments through a smartphone, get in touch or visit the Tap to Pay on iPhone website today.

*The oldest iPhone model that can support the feature is the iPhone XS, and the device must be running the latest iOS software. Some contactless cards may not be accepted by Tap to Pay on iPhone, and the feature is only available in certain markets.